Author

Scott Judson

Looking to grow your HSA savings while keeping costs low? Here's a quick guide to the top 5 HSA providers for 2024. These accounts not only help you save for medical expenses but also let you invest with tax advantages. Choosing the right provider can maximize your returns and simplify account management.

Key Highlights:

Fidelity: No fees, no minimums, advanced investment tools.

HealthEquity: Low investment threshold, employer integration, expense tracking.

Lively: No fees, mobile-friendly, self-directed and guided investing.

HSA Bank: Flexible investment options, fee waivers for higher balances.

Optum Bank: Employer-supported fees, integrated benefits, expense tracking.

Quick Comparison Table:

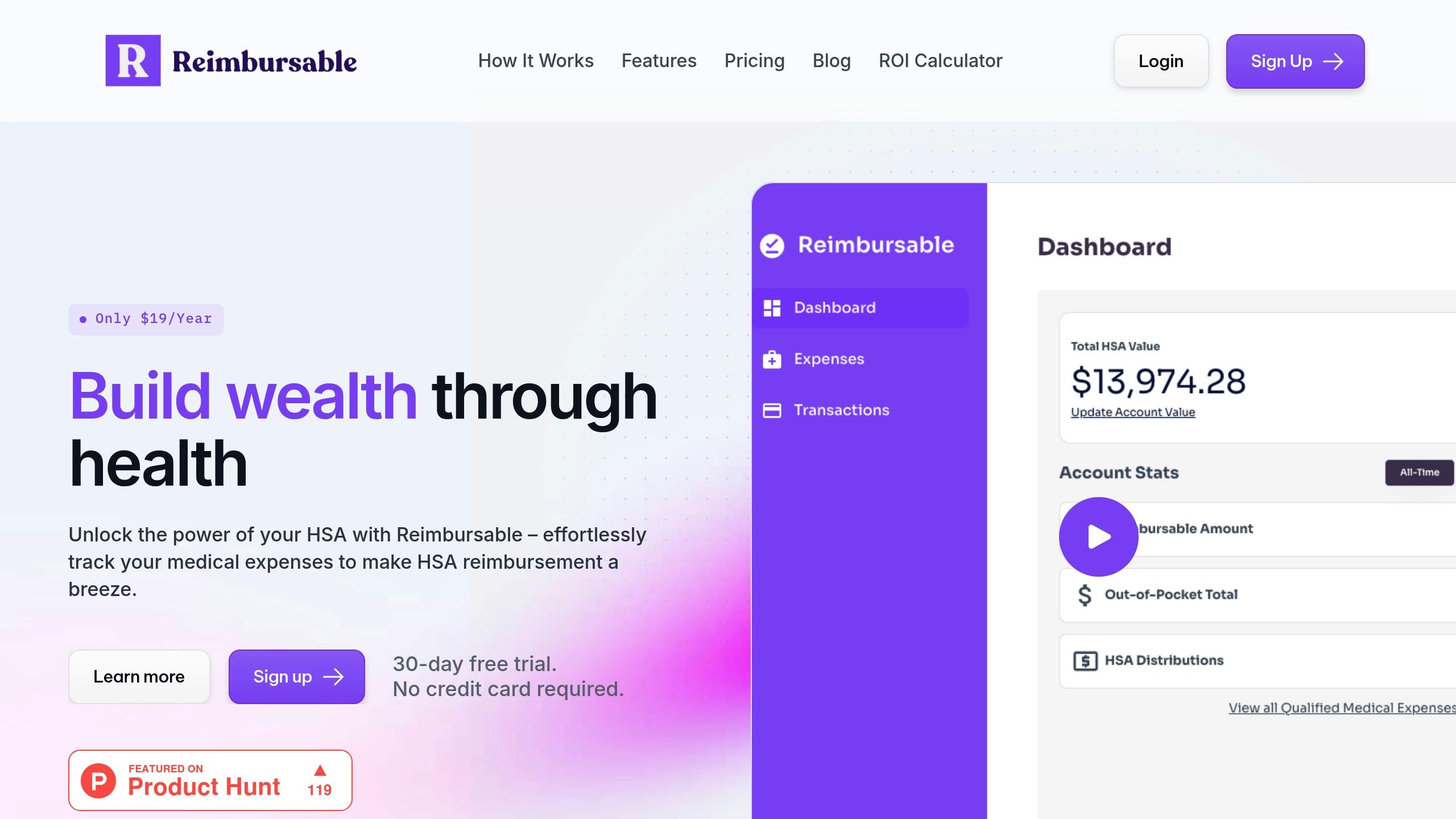

Pro Tip: Use tools like Reimbursable ($19/year) to track medical expenses and optimize tax-free reimbursements while your HSA investments grow.

Read on to learn how to choose the best HSA provider and maximize your savings!

Top 4 HSA Providers RANKED

How We Ranked HSA Providers

We focused on the key factors that influence long-term investment success and smooth account management.

Rating Factors

We evaluated providers using five main categories, giving the most weight to investment-related features:

Providers were scored based on these weighted criteria, with a strong focus on low fees and flexible investment options. All findings were verified through detailed research.

Research Methods

We used a systematic approach to ensure objectivity. Multiple data sources were analyzed to provide an accurate evaluation:

1. Direct Provider Analysis

We reviewed:

Fee schedules

Investment options and expense ratios

Minimum account requirements and investment thresholds

Platform features and technological tools

2. Independent Verification

We cross-checked provider details using:

Financial industry regulatory filings

Third-party investment research platforms

Independent HSA market reports

Verified user feedback

3. Feature Testing

We tested platforms for user interface quality, mobile app functionality, and customer support response times.

This thorough process allowed us to create rankings based on hard data, helping you make informed decisions about HSA providers.

5 Best HSA Investment Providers 2024

Fidelity Investments HSA Review

Fidelity stands out with its no-fee structure and extensive investment options. Users benefit from zero monthly maintenance or transaction fees, access to a wide variety of mutual funds and ETFs - including index funds with competitive expense ratios - and a full-service brokerage platform equipped with advanced research tools.

No minimum investment required

Zero fees

Advanced research tools

Wide selection of funds

HealthEquity HSA Review

HealthEquity combines investment options with seamless employer integration. The platform offers a curated list of mutual funds and a self-directed option for experienced investors. It features a low investment threshold, competitive pricing, and tools for managing expenses.

Low investment threshold

Built-in expense tracking

24/7 U.S.-based support

Self-directed investment options

Lively HSA Review

Lively provides a modern, user-friendly HSA investing experience, focused on mobile accessibility. It supports both managed portfolios and self-directed brokerage accounts, making it easy for investors of all experience levels to manage their HSAs.

No monthly fees for individual accounts

No minimum balance for investing

Mobile-first platform

Options for guided or self-directed investing

HSA Bank Review

HSA Bank offers flexibility with its tiered approach, providing both guided portfolios and self-directed trading options. Partnering with multiple investment providers, it caters to diverse investor needs while offering online banking tools and fee-waiver opportunities based on account balances.

Multiple investment partner options

Modest initial balance requirement

Fee waivers for higher balances

Integrated banking features

Optum Bank HSA Review

Optum Bank delivers a streamlined HSA investing experience, emphasizing employer benefits integration. It offers a core lineup of mutual funds and self-directed options for advanced investors, along with built-in tools for tracking expenses.

Dual investment options

Employer-supported fee structure

Integrated benefits programs

Enhanced expense tracking

To maximize your HSA's potential, consider tools like Reimbursable (https://reimbursable.com). For $19 per year, it helps track qualified medical expenses, keeping receipts and records organized for tax-free reimbursements while your HSA investments grow.

HSA Provider Feature Comparison

Key Features to Consider

When choosing an HSA provider, focus on the factors that can influence long-term growth. Pay close attention to fee structures, minimum balance requirements, investment options, digital tools, and customer support. These elements play a critical role in shaping your HSA's potential to grow over time.

Finding the Provider That Best Matches Your Needs

Once you've identified the key features, evaluate providers based on practical considerations. Here's how to break it down:

Investment Strategy: Determine whether you prefer the flexibility of immediate investing without minimums or curated portfolios designed to guide your investments.

Cost Consideration: Examine the fee structures and minimum balance requirements. Even small fees can have a noticeable effect on your overall returns.

Account Management: Seek out digital tools that make managing your HSA easier. For example, tools like Reimbursable can simplify expense tracking for $19 per year.

Integration and Support: Decide if you need features like integration with your employer’s benefits program or access to enhanced customer support.

To manage your HSA effectively, keep these steps in mind:

Calculate your annual costs based on your expected balance and account activity.

Ensure the investment options align with your financial strategy.

Evaluate the level of support and the quality of digital tools available for managing your account.

HSA Management with Reimbursable

Take control of your HSA by incorporating a reliable expense tracker into your strategy.

Reimbursable Platform Overview

Reimbursable simplifies the process of tracking HSA-eligible medical expenses and works seamlessly alongside your HSA provider. With secure Plaid bank integrations, the platform automatically detects qualifying expenses, helping you manage healthcare costs while allowing your HSA investments to grow.

The Do-It-Yourself plan is available for $19 per year. It includes unlimited expense entries, receipt storage, automatic identification of eligible medical expenses, annual tracking for HSA distributions, and support for preparing HSA tax form 8889.

Coming soon, the Full Service plan will cost $29 per month and offer additional features like virtual assistance for expense tracking and quarterly reimbursement reconciliation.

Using Reimbursable with Your HSA

Reimbursable helps you keep detailed records while maximizing the tax-free growth of your HSA funds. Staying organized is critical when balancing expense tracking with long-term investment goals.

"WOW I've been looking for a solution for medical expense tracking for sooooo long. Reimbursable greatly simplifies my medical expense tracking. I LOVE that I can track my total reimbursable amount. tons of peace of mind with this product!" – Sarah Thompson, Family of 5

The platform's tax preparation tools are especially helpful for HSA users. By keeping receipts and records of qualified medical expenses, you can confidently handle IRS audits, especially if you're covering costs out-of-pocket now and reimbursing yourself later from a growing HSA.

For optimal results, connect Reimbursable to both your HSA and the bank account you use for medical expenses. This setup ensures that you can track both your investment growth and reimbursable expenses in one place.

Summary and Next Steps

Provider Highlights

Each of our top 5 providers offers distinct advantages, catering to different needs. Whether it's Fidelity's zero-fee funds, HealthEquity's educational support, or Lively's user-friendly platform, there's something for everyone.

These features provide a solid foundation for choosing an HSA provider that aligns with your financial goals.

HSA Investment Best Practices

Focusing on providers with low fees and intuitive digital tools can significantly boost your HSA's growth. To get the most out of your HSA, choose a provider that matches your investment style and priorities. Key factors to evaluate include account fees, investment options, and platform ease of use.

Here are some tips to maximize your HSA's potential:

Keep detailed records: Store receipts securely for future reimbursements and IRS audits.

Automate contributions and investments: Set up automatic transfers to ensure consistent growth over time.

"really helpful tool for finding medical expenses and saving receipts. much easier than tracking in google sheets." - Alex Rodriguez, Family of 3

For smoother HSA management, link your account to expense tracking tools that automatically identify qualified medical expenses. This not only helps your investments grow tax-free but also makes recordkeeping and tax preparation easier. Tools like Reimbursable can simplify the process and save you time.

Related Blog Posts

5 HSA Setup Mistakes to Avoid in 2024