Author

Scott Judson

Keeping track of medical expenses for your HSA (Health Savings Account) can be overwhelming. Digital receipt apps simplify this process by securely storing receipts, automating expense tracking, and helping you stay tax-compliant. Here’s a quick look at the 10 best digital receipt apps for 2024 to manage your HSA expenses:

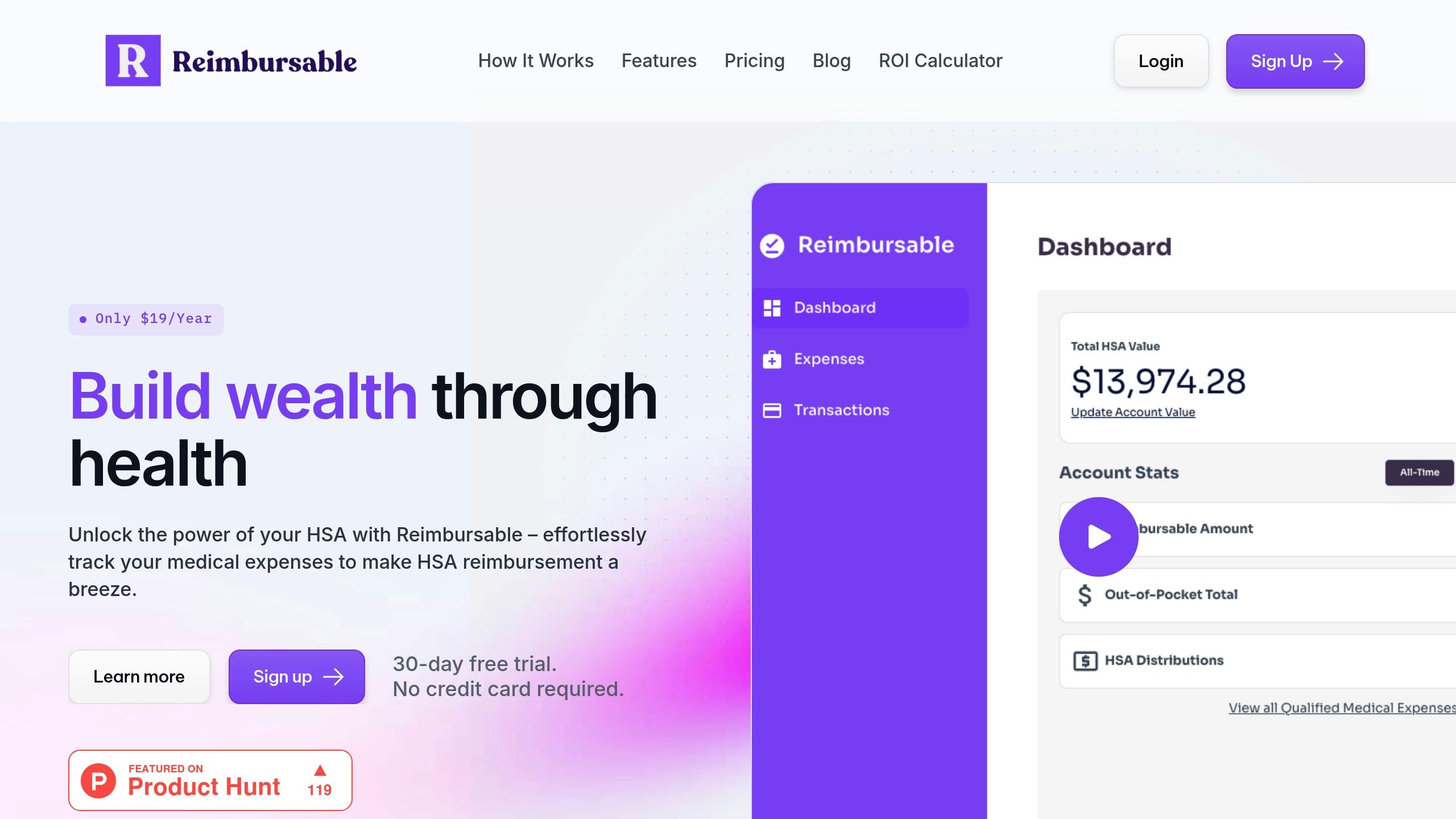

Reimbursable: Specifically designed for HSA tracking with automatic expense detection, tax form support, and secure storage. Plans start at $19/year.

Expensify: Great for general receipt management with cloud storage and search features, though not HSA-specific.

Neat: Offers digital storage but requires manual categorization for HSA expenses.

Shoeboxed: Converts paper receipts into digital files but lacks HSA-specific tools.

Wave Receipts: Simple receipt capture with no dedicated HSA features.

Evernote Scannable: High-quality receipt scanning but requires pairing with other tools for HSA management.

Smart Receipts: Basic receipt management with unclear HSA-related features.

Zoho Expense: Integrates with financial accounts to track HSA expenses but also caters to general business needs.

QuickBooks Online: Customizable expense tracking with detailed reporting, suitable for both business and medical expenses.

SAP Concur: Advanced receipt management for large organizations, but may be too complex for personal HSA use.

Quick Comparison

If you’re looking for a dedicated HSA solution, Reimbursable stands out with its affordable pricing and tailored features. For broader receipt management needs, apps like Expensify or QuickBooks Online may be a better fit. Choose based on your specific needs - whether it’s simplicity, automation, or advanced reporting.

What is the Best Way to Keep Track of HSA Expenses?

1. Reimbursable

Reimbursable simplifies HSA expense tracking by automatically identifying qualified medical expenses through connected bank accounts, ensuring compliance with HSA rules. It helps users keep track of out-of-pocket qualified medical expenses (QMEs) while allowing their HSA investments to grow tax-free.

These tools make it easy to store receipts securely while streamlining HSA expense management. Both plans include safe storage for medical receipts, giving users quick access during IRS audits and the ability to download their data whenever needed.

The Do-It-Yourself plan is a great option for families who prefer to manage their HSA expenses independently. On the other hand, the Full Service plan offers extra features like virtual assistance and detailed monthly spending reports for users who want more hands-on support.

Reimbursable’s integration with Plaid takes the hassle out of tracking HSA expenses by automatically detecting eligible medical expenses from linked accounts. This not only saves time on manual entries but also improves accuracy when preparing taxes. Users can view real-time HSA balances and reimbursement totals. Both plans come with a 30-day free trial - no credit card required.

2. Expensify

Expensify is a popular app designed to simplify receipt management. With its mobile app, you can quickly snap photos of your receipts and store them securely in the cloud, making it easy to access them anytime - perfect for HSA or tax filings. While it’s not specifically designed for HSA tracking, its intuitive design and powerful search features make it a handy tool for organizing both medical and non-medical receipts. This helps you keep accurate records of eligible expenses, which is key for managing a Health Savings Account. Expensify is a solid choice for handling both HSA-related and general expenses with ease.

3. Neat

Neat turns physical receipts into searchable digital records but doesn't offer tools specifically for managing HSA-related documents.

For those using digital receipts to track HSA expenses, organizing and categorizing must be done manually. Here's what you should know:

Digital storage: Receipts can be stored electronically, but there's no HSA-specific tracking feature.

Manual categorization: Users are responsible for identifying and organizing HSA-eligible expenses on their own.

Security concerns: The app doesn't provide detailed information about how stored receipts are protected.

If you're managing an HSA, consider platforms that combine digital receipt storage with dedicated tools for tracking HSA expenses. Up next, we'll cover apps that offer both.

4. Shoeboxed

Shoeboxed helps you turn paper receipts into digital files, making storage and organization easier. However, it doesn't offer specific tools for managing HSA expenses, so you'll need to rely on other software or manual methods to track those.

Key Feature: Converts paper receipts into digital copies for better organization.

While it's great for basic receipt storage, Shoeboxed falls short when it comes to handling all aspects of HSA management.

5. Wave Receipts

Wave Receipts is a feature within Wave's financial software suite, designed for simple receipt capture and storage. However, it doesn't cater specifically to HSA expense tracking. If managing HSA expenses is a priority, consider comparing it with platforms tailored for that purpose. Up next, we'll look at apps built specifically for HSA tracking.

6. Evernote Scannable

Evernote Scannable is a handy tool for digitizing receipts with its automatic scanning and image adjustment features. However, it doesn't include built-in HSA-specific tracking, so you'll need additional tools to manage healthcare expenses effectively.

The app's scanning system automatically identifies receipt edges and adjusts the image for better clarity. This comes in particularly handy for crumpled or faded medical receipts. It ensures the text is clear and easy to read, which is crucial for both reference and HSA audits.

Key Features for Receipt Management:

Automatic edge detection for multi-page scanning

Scans business cards and standard documents

Syncs directly with the primary Evernote platform

Offers cloud storage with searchable text recognition

Exports files to PDF and other widely used formats

HSA Expense Management Challenges

While Scannable is excellent for capturing and storing receipts, it doesn't offer automated HSA categorization or compliance checks. This means users will need to manually organize receipts for healthcare-related expenses.

If you're already using Evernote, Scannable can complement your HSA management efforts. However, its lack of HSA-specific tools highlights the need for pairing it with dedicated expense management software for a more complete solution.

7. Smart Receipts

Currently, there’s no confirmed information about Smart Receipts' ability to track HSA-related expenses. While it serves as a receipt management tool, details about its features, performance, and compatibility with HSA requirements remain unclear. This highlights the importance of relying on tools specifically designed for HSA tracking.

Options like Expensify and Reimbursable are well-known for their ability to handle HSA tasks effectively. They offer features such as tracking qualified medical expenses, managing documentation, integrating with HSA providers, and ensuring compliance with IRS guidelines. When exploring alternatives, focus on tools that provide:

Dedicated HSA categorization

Integration with HSA providers

Secure receipt documentation

Strong data protection measures

For accurate HSA tracking, it’s crucial to choose solutions with proven capabilities. The alternatives mentioned above are worth considering.

Note: This section will be updated if verified details about Smart Receipts' HSA-specific features become available.

8. Zoho Expense

Zoho Expense provides an easy way to handle digital receipts and track HSA-related expenses. By connecting directly to financial accounts, it simplifies managing healthcare expenses. Some standout features include:

Automatically identifying eligible medical expenses via bank account integration

Safe storage for medical receipts and related documents

Help with preparing tax forms

Options for managing future HSA distributions

While Zoho Expense covers both business and medical expenses, those solely interested in HSA tracking might lean toward tools designed specifically for that purpose.

9. QuickBooks Online

QuickBooks Online simplifies managing HSA-related expenses by digitizing receipts and pulling out essential details automatically. It extracts information like transaction dates, vendor names, payment amounts, expense categories, and tax details straight from scanned receipts.

Although it's not specifically designed for HSA tracking, the platform allows users to customize expense categories, tag HSA-eligible expenses, and review reports on both desktop and mobile devices. Its detailed reporting tools make it easy to create custom reports, export records for tax purposes, and analyze spending habits. Plus, integration with third-party tools expands its functionality, making it a great option for those juggling both business and healthcare expenses.

10. SAP Concur

SAP Concur is a receipt management tool tailored for large organizations. It streamlines HSA expense tracking by combining receipt capture with detailed expense reporting. While packed with features for handling multiple accounts, it might feel overly complex for individual HSA users or small businesses. Up next, find out how to choose the right app for managing your HSA receipts.

How to Choose an HSA Receipt App

When managing your Health Savings Account (HSA), having the right app for receipt tracking and expense management can make a huge difference. Here's what to consider when selecting one.

HSA Compliance and IRS Requirements

The app you choose should help you stay on top of qualified medical expenses (QMEs) and securely store receipts in case of an IRS audit. It should also make preparing tax forms easier and provide a clear view of your HSA balance and reimbursements.

Security and Data Protection

Since you're dealing with sensitive information, security is non-negotiable. Look for apps with these features:

Bank-grade encryption to protect data during transmission

Safe and secure receipt storage

Integration with trusted services like Plaid

Regular updates to adhere to the latest security standards

Expense Detection and Management

A good app should simplify tracking by automatically identifying eligible expenses through bank or credit card integrations. This eliminates the need for manual entry and ensures accurate records for HSA compliance.

Cost Considerations

Some apps are free, but advanced features often come with a subscription fee. Weigh the cost against the value of features like security, automation, and customer support to decide if it’s worth the price.

User Experience and Support

A user-friendly app can make managing medical expenses less stressful. Key features to look for include:

Easy receipt uploads and organization

Tools to monitor spending over time

Report generation for tax purposes

Accessible and reliable customer support

Integration Capabilities

Check how well the app works with your existing financial tools and HSA provider. Seamless connections to bank accounts, credit cards, and tax software can simplify expense tracking and ensure accurate record-keeping. A well-integrated app will fit smoothly into your financial management routine.

Wrapping It Up

Each app brings something different to the table, catering to various user needs. Based on our review, apps specifically designed for HSA tracking stand out for their precision and compliance features. For example, Reimbursable shines with its straightforward $19/year Do-It-Yourself plan tailored for HSA users.

Key features to look for in an effective solution include:

Automatic expense detection paired with secure receipt storage

Multi-user support for managing family expenses

Integration options with your current financial tools

Strong tax compliance tools to simplify preparation

While dedicated HSA apps are great for managing family medical expenses, broader tools like Expensify or Zoho Expense also include HSA tracking but focus more on overall business expense management.

Think about how you plan to use the app. If you're an individual, automatic tracking and basic storage might be all you need. Families, on the other hand, benefit from apps with advanced categorization tools. For business owners, integrated solutions that handle both personal HSA and business expenses are a must.

Keeping an eye on these features will help you pick the best app for managing your HSA expenses as new options and updates hit the market.

Related Blog Posts

5 HSA Setup Mistakes to Avoid in 2024