Author

Scott Judson

Health Savings Accounts (HSAs) offer a rare triple tax advantage: tax-deductible contributions, tax-free investment growth, and tax-free withdrawals for qualified medical expenses. This makes HSAs a powerful tool for reducing taxes, saving for healthcare costs, and building long-term wealth. Here’s how you can maximize these benefits:

Tax-Free Contributions: Contributions lower your taxable income. In 2025, you can contribute up to $4,150 (individual) or $8,300 (family), with an extra $1,000 if you’re 55+.

Tax-Free Growth: Invest HSA funds in mutual funds or ETFs for untaxed growth. Keep receipts to reimburse yourself later while your investments grow.

Tax-Free Withdrawals: Use HSA funds for qualified medical expenses like doctor visits, prescriptions, and dental care without paying taxes.

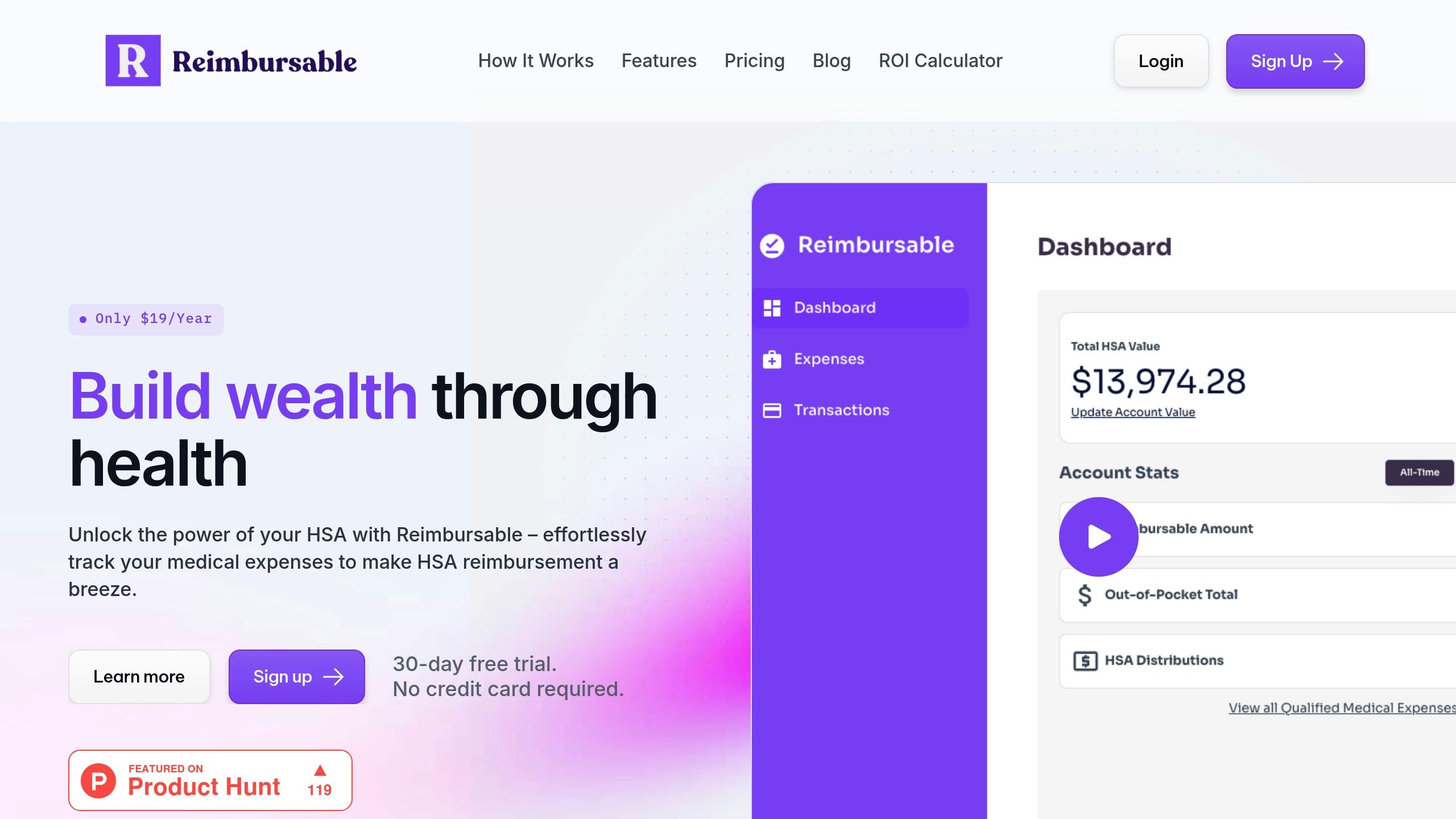

Pro Tip: Use tools like Reimbursable ($19/year) to track expenses and manage receipts, ensuring you never miss a tax benefit.

HSAs are a smart way to save for future healthcare costs while enjoying significant tax savings today.

The Complete Guide to Health Savings Account (HSA) Tax Benefits

Tax-Free HSA Contributions

Contributing to a Health Savings Account (HSA) reduces your taxable income on a dollar-for-dollar basis. If contributions are made through payroll deductions, they are deposited using pre-tax dollars, which means you avoid federal, Social Security, and Medicare taxes. If you contribute directly, those amounts are fully deductible on your tax return.

2025 Contribution Limits

The IRS sets limits on how much you can put into your HSA each year. Here are the limits for 2025:

These limits apply to the total contributions made by both you and your employer. For example, if you have family coverage and your employer contributes $2,000, you can personally contribute up to $6,300 for the year ($8,300 - $2,000 = $6,300).

Employer HSA Contributions

Many employers add to their employees' HSAs as part of their benefits package. These contributions come with several perks:

They count toward your annual limit but are not considered taxable income.

The funds are available immediately for qualified medical expenses.

Employer contributions are exempt from Social Security and Medicare taxes (FICA).

For example, if your employer contributes $100 per month ($1,200 annually) and you’re in the 24% tax bracket, this saves you about $288 in federal income taxes and $91.80 in FICA taxes.

To get the most out of your HSA, aim to contribute the maximum amount allowed after factoring in employer contributions. This approach helps you maximize tax savings while building a solid fund for current and future healthcare costs. Up next, see how tax-free investment growth can further boost your HSA benefits.

Tax-Free HSA Investment Growth

One standout feature of an HSA is its potential for tax-free investment growth. Unlike regular investment accounts where earnings are taxed, any gains from HSA investments remain untaxed - as long as they're used for qualified medical expenses.

HSA Investment Options

Most HSA providers require you to keep a minimum cash balance before you can start investing. Once you meet that threshold, you'll typically gain access to options like mutual funds, ETFs, and interest-bearing accounts. Check your account details to understand the specific minimum balance requirements.

Tips for Maximizing HSA Growth

Here are some practical strategies to help you make the most of your HSA investments:

Keep Track of Medical Expenses

Document all qualified medical expenses so you can allow your investments to grow while still preserving the option to reimburse yourself later.

Organize Receipts

Store medical receipts in a secure location for future reimbursement claims or potential IRS audits. Tools like Reimbursable can simplify this process by automating receipt management.

Stick to Your Investment Plan

Approach your HSA investments with a long-term mindset. Consistent, disciplined investing can help maximize tax-free growth over time.

Maintain a Cash Reserve

Keep some funds in cash for short-term medical needs. This helps you avoid selling investments during market dips to cover immediate expenses.

Tax-Free Medical Expense Withdrawals

Withdrawals from an HSA for qualified medical expenses are not subject to taxes.

Eligible Medical Expenses

The IRS has clear rules about what counts as qualified medical expenses for tax-free HSA withdrawals. Here are some common examples:

Record Keeping Requirements

To keep your HSA withdrawals tax-free, you need to maintain proper records. The IRS requires the following:

Receipts detailing the service provider, date, and cost

Descriptions of the medical services or items purchased

Proof that the expenses weren’t covered by insurance

Records stored for at least three years after you file your taxes

Using a digital tool can make managing these records much easier.

Simplifying with Reimbursable

Digital tools like Reimbursable can streamline the process of tracking HSA expenses. For $19 per year, the platform offers:

Automatic detection of medical expenses by linking to your bank accounts

Secure storage for digital receipts

Tracking of HSA distributions

Help with preparing HSA tax form 8889

"I finally found a solution for tracking my medical expenses. Reimbursable simplifies the process and gives me peace of mind by clearly tracking my reimbursable amounts." - Sarah Thompson, Family of 5

Reimbursable’s automatic detection feature ensures you won’t overlook eligible expenses, while helping you keep everything organized for tax purposes. This approach minimizes the chances of tax penalties and helps you make the most of your HSA.

HSA Tax Savings Tips

Take full advantage of your HSA's tax-free contributions, growth, and withdrawals with these smart strategies to strengthen your long-term savings.

Contribution Strategies

Contribute the maximum allowed to your HSA as early as possible each year. This gives your funds more time to grow and benefit from tax-free earnings.

Planning for Future Medical Costs

A little planning can go a long way in boosting your healthcare savings:

Track Current Expenses: Use digital tools to keep an organized record of your medical costs. This makes it easier to manage reimbursements later.

Invest Your HSA Funds: Instead of letting your HSA balance sit idle, consider investing it. This can lead to tax-free growth and provide a cushion for future medical needs.

Common HSA Mistakes to Avoid

Conclusion

Health Savings Accounts (HSAs) provide three key tax benefits: tax-deductible contributions, tax-free investment growth, and tax-free withdrawals for qualified medical expenses. These features not only lower your current tax bill but also help you grow a dedicated healthcare fund for the future.

Making the most of your HSA can have a big financial impact. By contributing the maximum allowed in 2025 and investing those funds strategically, you can take full advantage of one of the best tax-friendly savings options for healthcare costs.

Managing your HSA effectively involves keeping track of expenses and storing receipts. Tools like Reimbursable ($19/year) simplify this process by identifying eligible medical expenses and keeping digital records for reimbursements or IRS audits. Staying organized with your HSA ensures you get the most out of its tax benefits while preparing for future healthcare expenses.